Tax needn’t be so taxing!

None of us likes paying tax. So how galling to find that your hard-earned assets which suffered Income Tax when you were working will also be subject to Inheritance Tax when you die.

But writing a will (or rewriting an existing one) is the perfect opportunity to use perfectly lawful mechanisms to structure your affairs in a way that will minimise the tax payable on your estate.

Although you can give away assets while you are still alive in order to reduce your taxable estate, this doesn’t suit most of us because we simply don’t know what our needs will be in later life. In any event, such gifts will be fully tax-free only after seven years have elapsed.

There are some basic principles relevant for Inheritance Tax planning:

- You can leave as much as you like tax-free to your spouse or to UK-registered charities.

- Each person can leave their own allowance, known as the Nil Rate Band (NRB), tax-free to whomever they wish. The NRB is currently £325,000, and has been frozen at this level until at least 2028.

- In addition a Residence Nil Rate Band (RNRB) of £175,000 is also available where a property is left to descendants.

- In the case of a married couple, if the NRB and RNRB of the first to die is not fully utilised, the unused allowance(s) can be carried forward, giving an equivalent uplift of the surviving spouse’s NRB and RNRB on second death.

- Whist some categories of asset are currently tax free, this will change in the coming two years following the Chancellor’s October 2024 Budget bringing Business and Agricultural property as well as pension pots into the Inheritance Tax framework.

Whilst the impact of Inheritance Tax can be bad news for us as individuals, the availability of exemptions from tax for charitable legacies means we are fiscally encouraged to support our favourite causes without it detracting significantly from our family’s inheritance. And this incentivisation has only been encouraged since the Government went further, some 13 years ago, and reduced the tax rate on our estate where we leave at least 10% of our taxable estate to charity.

Let’s take a very typical example: a married couple with children, and a joint estate of £1.55m:

Helen and David Goldstein have an estate of £1.55m, including their home, which they know that they can leave completely free of Inheritance Tax to each other. But they want to know how much tax will be paid by their three adult children, on second death, and in particular what it will ‘cost’ their children for them to leave a legacy gift to charity.

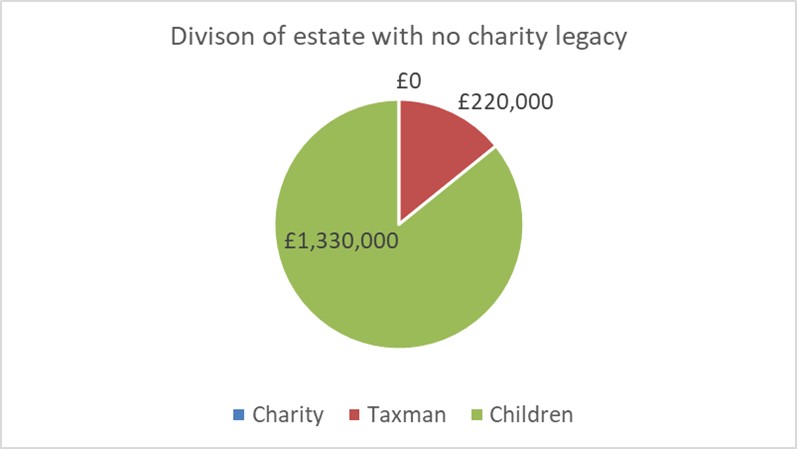

If they leave everything to the children then the first £1m of their estate will be tax free but the remainder, £550k will be taxed at 40%. So the taxman will take £220,000, leaving £1.33m for the children, around £440,000 each:

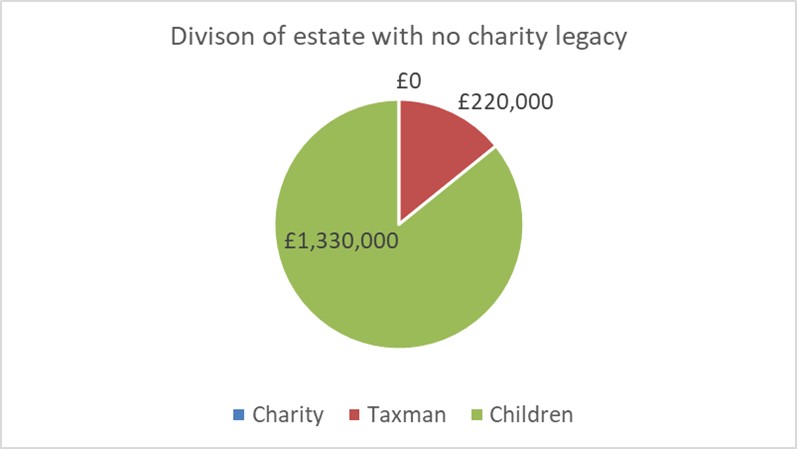

However, Helen and David are pleasantly surprised to discover that by leaving a charity legacy gift equal to 10% of the taxable estate – £55,000 – not only will that gift be tax deductible, but their estate will also benefit from a generous tax relief reducing the Inheritance Tax rate to 36%:

Most of the £55,000 charity legacy gift is borne by the taxman, and just £13,200 of it by the children. The entire family consider that’s a small price to pay for their favourite charity to benefit by four times more than that sum. The children will each now inherit £439,000, just £4,000 less than without the charity legacy.

So tax needn’t be so taxing! With expert advice, proper planning and a philanthropic attitude, Inheritance Tax on your estate could be significantly reduced, or wiped out completely, to the benefit of both your family and your favourite causes.

For more information contact Harvey Bratt, solicitor and UJIA Director of Planned Giving on 020 7424 6431 or harvey.bratt@ujia.org.

Note: The above was prepared in March 2025 and summarises the requirements of then current legislation regarding Charity Relief from Inheritance Tax. The information contained above is general in nature. Comprehensive legal advice can only be provided on a case by case basis depending on each person’s own individual personal, family, financial and tax circumstances.